A question I get asked all the time is: ‘What can I take out of my business?’ and ‘how do I save more tax?’

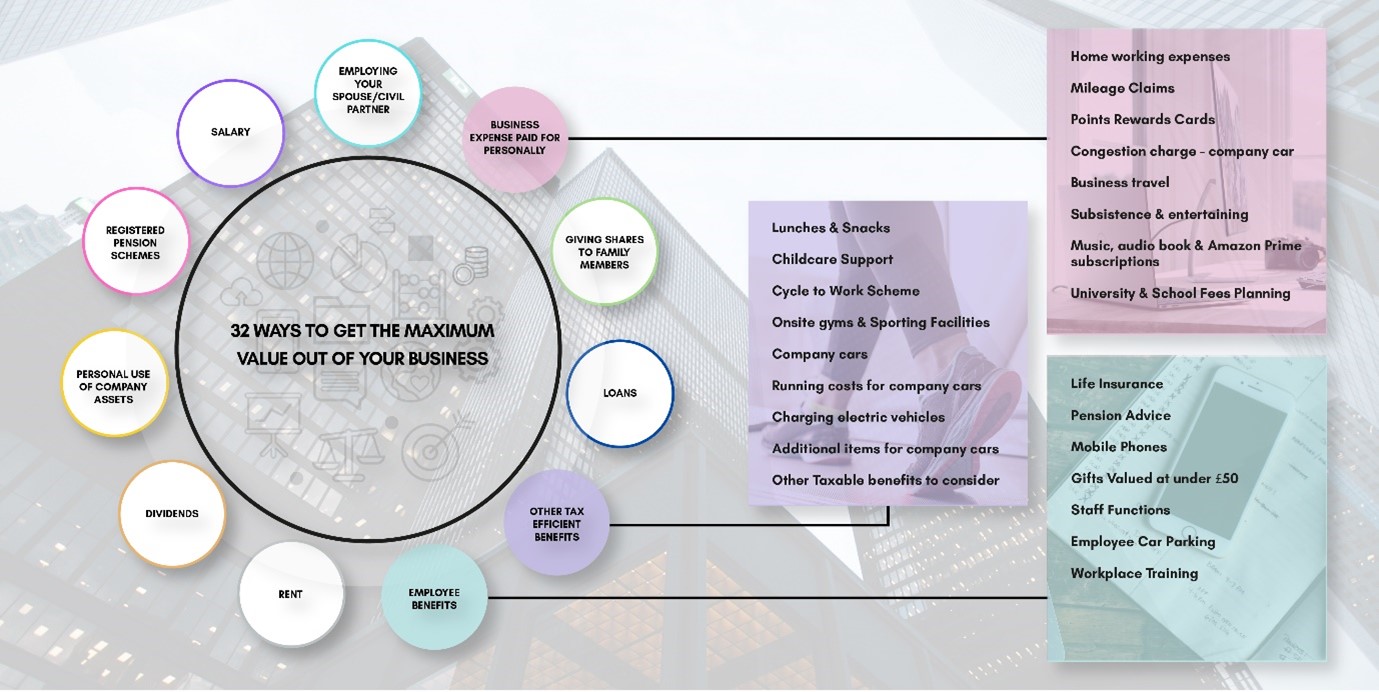

Well, the quick answer is, ‘there’s up to 32 ways to get value out of your business, tax efficiently.’ Yep, that’s a lot of ways!

But the truth is, not all these 32 ways will be relevant to you and your business, and it’s likely that you’ll already be doing a few of them. But how do you know if you’re maximising every opportunity you could be, to improve your life, your families and your employees?

Value Extracting Tax Diagnostic Review

Well, we have a tax diagnostic review service that will do exactly that for you.

In our Value Extracting Tax Diagnostic review we will analyse your business and personal circumstances against the 32 ways, to identify all the ways you can tax efficiently put things through the business, or take value out of the business, benefitting you, your family and even your employees.

Every business owner can extract loads of value from their business, you just need to know what is relevant for you.

Get a tailored quote today whereby we GUARANTEE to deliver value of three times the cost otherwise you pay us nothing.

Let’s have a chat

If you’d like to review how much value you’re getting from your business, we’d love to speak to you, book in a call & let’s have a chat by following the link here.

Tennick support packages

Hindsight

What it includes:

- Keep you compliant

- Provide you with a dedicated HMRC point of contact

Foresight

What it includes:

- Real-time information

- Cash flow management

- Financial roadmap

Insight

What it includes:

- Real-time business insights

- Financial and retirement roadmap

- Accountability and strategic direction